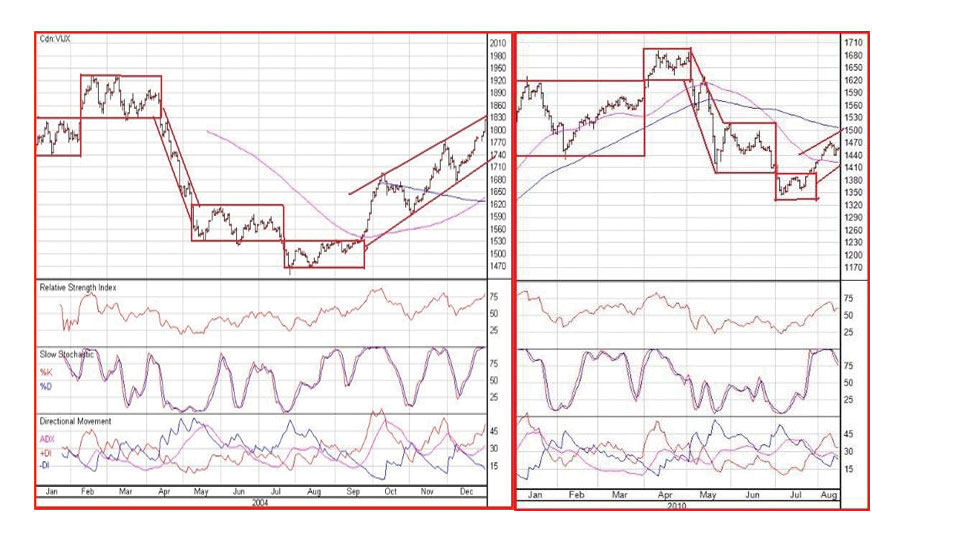

On July 16, BMR posted an important and very popular article (“Hopeful Sign: 2010 CDNX Chart Looks Like Repeat of 2004“) that compared the 2010 CDNX with the 2004 CDNX. This research was significant additional evidence that the CDNX may have hit bottom in early July and helped us immensely in issuing a very bullish forecast at that time (helping our readers make money) for both the CDNX and Gold.

Today, a month later, BMR’s technical analyst is going to revisit this striking comparison (we have re-posted the July 16 article for reference purposes – we suggest you read it or read it again – in order to fully understand and appreciate this morning’s update).

At BMR we have used the CDNX as an extremely effective leading indicator, which it is – for the broader markets, for Gold and commodities in general, and even for the overall economy. This is one of the world’s great speculative markets and the CDNX is also very resource-based. That’s why the technical health of the CDNX is so important to monitor. As a classic example, when Gold and oil were both strong and moving higher in the first half of July, 2008, the CDNX was going in the opposite direction and broke down severely by the end of the month – moving much quicker to the downside than the Dow or the TSX. This signaled that major trouble was ahead (speculative money is always the first to flee danger) and sure enough markets across the board soon crashed. That’s why we don’t believe in the theory being advanced by some analysts right now that another major crash is on the way – the CDNX is not confirming this. To the contrary, the CDNX has been leading the overall markets (and Gold) to the upside over the past 6 weeks. Far from an imminent crash, we could very easily be on the verge of a major upside breakout. That’s what the CDNX is telling us.

Below, on the left, is the CDNX 2010 chart while the 2004 CDNX chart is beside it on the right.

John: With this update let us cover the period from July 1 to Aug 13. This is a very important period because it includes the lows of each year and the expectation of a reversal to the upside. We see on the 2004 chart the CDNX was in a horizontal trend channel and did not break to the downside into a lower horizontal channel until the third week in July. On the 2010 chart we see that the CDNX moved into the lower channel around July 1, so the base consolidation started about 3 weeks earlier. The eagerly awaited breakout to the upside on the 2004 chart occurred around the 3rd week of September whereas this year it occurred during the 3rd week of July – 2 months earlier.

John: With this update let us cover the period from July 1 to Aug 13. This is a very important period because it includes the lows of each year and the expectation of a reversal to the upside. We see on the 2004 chart the CDNX was in a horizontal trend channel and did not break to the downside into a lower horizontal channel until the third week in July. On the 2010 chart we see that the CDNX moved into the lower channel around July 1, so the base consolidation started about 3 weeks earlier. The eagerly awaited breakout to the upside on the 2004 chart occurred around the 3rd week of September whereas this year it occurred during the 3rd week of July – 2 months earlier.

After the breakouts, the CDNX, on both charts, has moved in exactly the same pattern and in an upsloping channel. The outlook for the remainder of this year is very bullish. I expect we will see the Index continue to move up in an orderly manner within the upsloping channel until at least the end of the year.